Financial Statements 2

Importance of Trading account

i. It is used to determine the gross profit/loss for a given trading period for appropriate decision making by the management.

ii. It is used in determining the cost of goods that was sold during that particular accounting period.

iii. It is used to reveal the volume of turnover i.e net sales

iv. May be used to compare the performance of the business in the current accounting period and the previous periods. It can also compare its performance with other similar businesses.

v. It facilitates the preparation of profit and loss account, since the gross profit is carried forward to the profit and loss account.

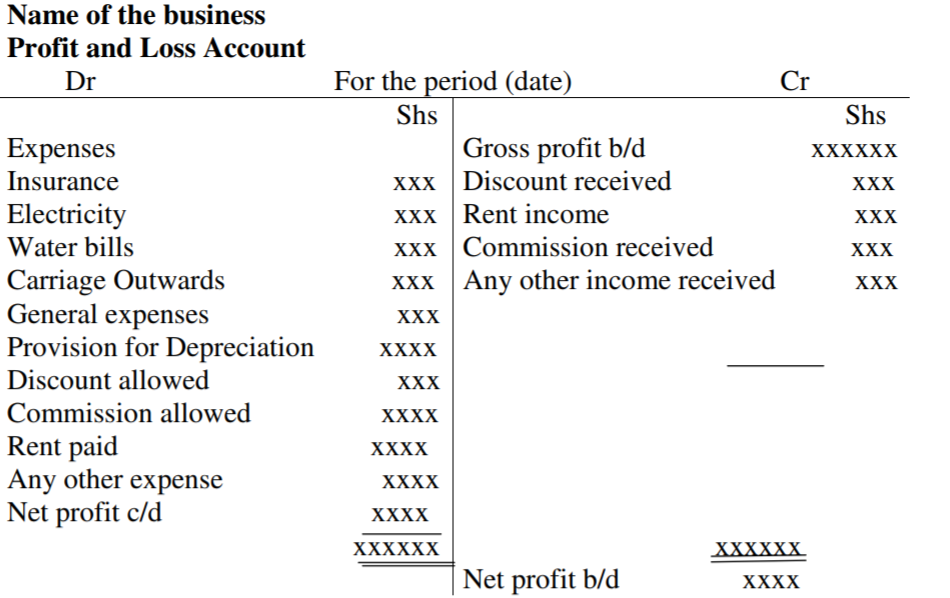

Profit and Loss account

In preparation of this account, the gross profit is brought down on the credit sides, with all other revenues/income of the business being credited and the expenses together with the net profit being debited. Net profit = Total

Revenues (including Gross Profit) – Total expenses

The Profit and Loss Account is complete when net profit b/d is obtained.

In the trial balance, the revenues/incomes are always credited, while the expenses are debited, and the same treatment is found in the Profit and Loss Account.

(Any item that is taken to the Profit and Loss Account with a balance appearing in the Debit (Dr) side of a trial balance is treated as an

expense, while those appearing in the Credit (Cr) side are revenue e.g.discount balance appearing in the Dr Side is Discount Allowed, while the one on Cr side is Discount Received)

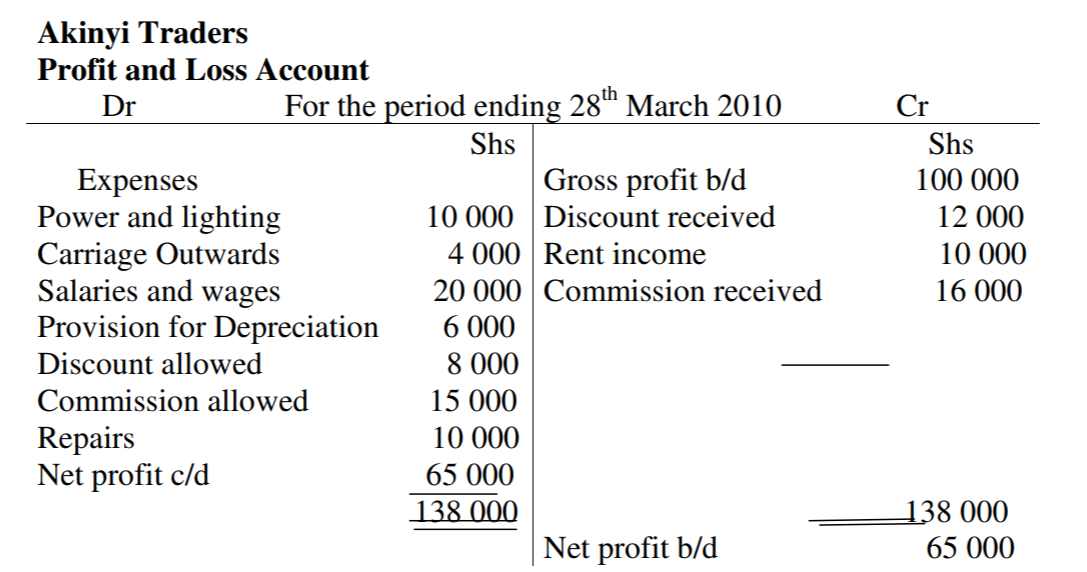

For example The following information relates to Akinyi’s Traders for the period ending

March 28th 2010. Use it to prepare profit and loss account.

Gross profit 100 000

Discount received 12 000

Salaries and wages 20 000

Power and lighting 10 000

Opening stock 150 000

Rent income 10 000

Commission allowed 15 000

Commission received 16 000

Repairs 10 000

Discount allowed 8 000

Provision for depreciation 6 000

Carriage outwards 4 000

In case the expenses are more than the income, then the business shall have

made a net loss, and the loss will be credited.

Net profit/loss can also be found through calculation as follows;

Net profit/loss = Gross profit + Total other revenues – Total expenses

For the above example;

Total other revenues = 12 000 + 10 000 + 16 000= 38 000

Total expenses = 10 000 + 4 000 + 20 000 + 6 000 + 8 000 + 15 000 + 10 000 = 73 000

Therefore; Net profit = Gross profit + Total other revenues – Total expenses = 100 000 + 38 000 – 73 000= 65 000

Importance of Profit and Loss account

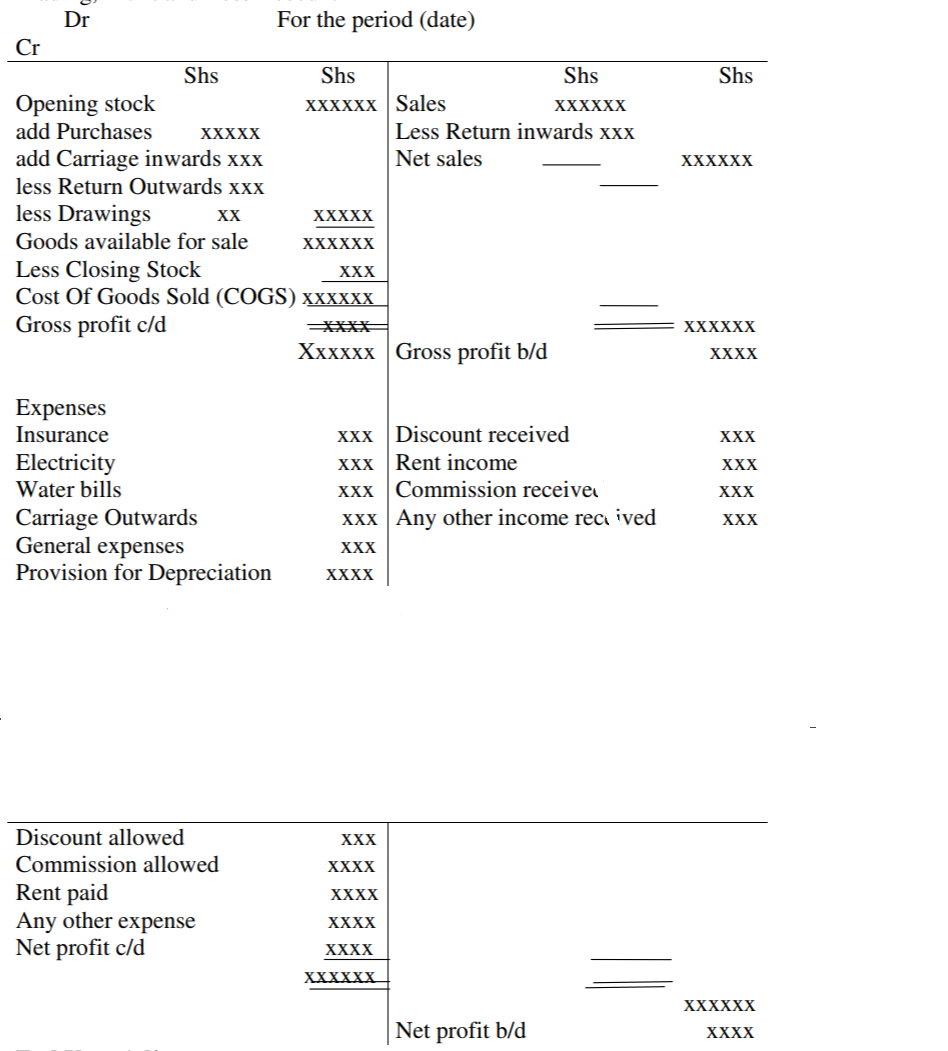

Trading, Profit and Loss Account

This is the combination of trading account and trading profit and loss account to form a single document.

It ends when the net profit/loss brought down has been determined. That is;

Name of the business

Trading, Profit and Loss Account

End Year Adjustments

The following items may require to be adjusted at the end of the trading period

Revenues/Income

Expenses

Fixed assets

Adjustment on revenues

The revenue may have been paid in advance in part or whole (prepaid revenue) or may be paid later after the trading period (accrued revenue).

Prepaid revenue is subtracted from the revenue/income to be received and the difference is what is treated in the profit and loss account or trading profit and loss account as an income, while the accrued revenue is added to the revenue/income to be received and the sum is what is treated in the above accounts as the actual revenue.

Only the prepaid amount and the accrued amounts are what are then taken to the balance sheet.

Adjustment on the expenses

The expenses may have been paid for in advance in part or whole (prepaid expenses) or may be paid for later after the trading period (accrued expenses).

Prepaid expenses is subtracted from the expenses to be paid for and the difference is what is treated in the profit and loss account or trading profit and loss account as an expense.

While the accrued expenses is added to the expenses to be paid for and the sum is what is treated in the above accounts as the actual expenses.

NB: Only the prepaid amount and the accrued amounts are what are then taken to the balance sheet.

Adjustment on fixed assets

The fixed assets may decrease in value, due to tear and wear.

This makes the value to go down over time, what is referred to as depreciation.

The amount of depreciation is always estimated as a percentage of cost.

The amount that shall have depreciated is treated in the profit and loss account or T,P&L as an expense, while the value of the asset is recorded in the balance sheet, less depreciation.

Financial Statements 1 | Financial Statements 2 |

Financial Statements 3 | Financial Statements 4 |

Scholarship 2025/26

Current Scholarships 2025/2026 - Fully FundedFull Undergraduate Scholarships 2025 - 2026

Fully Funded Masters Scholarships 2025 - 26

PhD Scholarships for International Students - Fully Funded!

Funding Opportunities for Journalists 2025/2026

Funding for Entrepreneurs 2025/2026

***